Latest Articles

Read our previous and latest articles.

| Title |

|---|

Building Your Business with Sunoco: A Fuel Partner for GrowthOctober 16, 2024 | 5 Minutes Read Time In the fuel industry’s competitive landscape, aligning with a renowned and reliable brand can be the crucial differentiator that drives business success and growth. |

If You’re Short on Staff, Focus on These 3 Things FirstOctober 9, 2025 | 5 Minutes Read Time Staffing shortages are still a daily reality for many gas station and convenience store operators. Turnover remains high, and finding qualified employees has only gotten harder. |

3 Small In-Store Changes That Can Increase SalesOctober 7, 2025 | 5 Minutes Read Time Independent station owners don’t always have the time or resources for full renovations. But small, intentional changes can drive measurable results. |

What Customers Expect from Modern Fuel Stations in 2025July 9, 2025 | 5 Minutes Read Time Discover what fuel station customers want in 2025—from faster fill-ups to TOP TIER™ fuel and upgraded c-stores. |

Building Trust and Loyalty at the Pump with Sunoco’s BrandJanuary 23, 2025 | 5 Minutes Read Time Customer loyalty is essential for success in the competitive fuel retail industry. By partnering with Sunoco, gas station owners can build a loyal customer base. |

Fueling Margin: The Advantage of Offering Race Fuels at Gas StationsOctober 29, 2024 | 5 Minutes Read Time NASCAR®’s official fuel provider, Sunoco, shares insights on how gas stations that incorporate race fuels can gain a competitive edge. |

Choosing Sunoco as Your Race Fuel SupplierOctober 16, 2024 | 5 Minutes Read Time For businesses catering to the high-energy world of motorsports, including convenience stores, performance shops, and mechanics, offering race fuel can increase... |

Combating Global Poverty: Sunoco's Continued Support for Aga Khan Foundation USAMay 21, 2024 | 5 Minutes Read Time Sunoco partners with Aga Khan Foundation USA to combat global poverty through sustainable development initiatives. |

We Succeed When You Succeed: Sunoco as Your Brand PartnerApril 25, 2024 | 4 Minutes Read Time Thinking about your station’s brand partner options? A recent NACS feature from Sunoco covers some considerations for deciding what fuel to carry. |

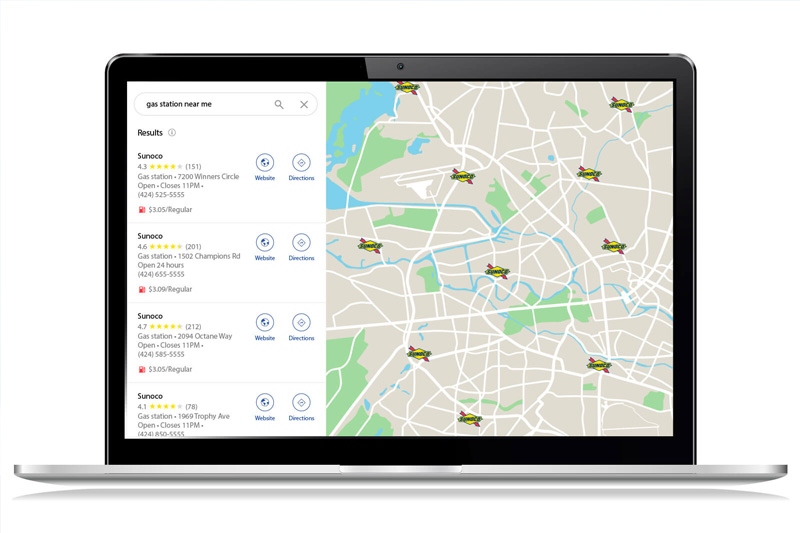

Boost Your Station's Visibility Online Using a Google Business ProfileApril 25, 2024 | 2 Minutes Read Time Did you know 75 percent of online location searches result in a same-day store visit? |

Sunoco’s Mystery Shoppers Tell It Like It IsApril 25, 2024 | 2 Minutes Read Time When we become used to our surroundings and life routines, it becomes easy to overlook little (and even big) things that are more obvious to others. |

Help Wanted: Creatively Competing in Today’s Labor MarketApril 25, 2024 | 5 Minutes Read Time Labor shortages affect nearly every industry and business, regardless of type or size, in employee attraction, retention, and labor costs. Learn to attract and retain top employees. |

Report: Convenience Stores are on the RiseApril 25, 2024 | 2 Minutes Read Time For the second year, convenience stores have grown in the US, firmly reversing a four-year decline in previous years. |

Keep it Clean to Drive Business: The Impact of Cleanliness on Gas Station SuccessApril 25, 2024 | 2 Minutes Read Time Did you know station cleanliness drives visits? A site’s cleanliness is directly tied to higher perceptions of fuel quality... |